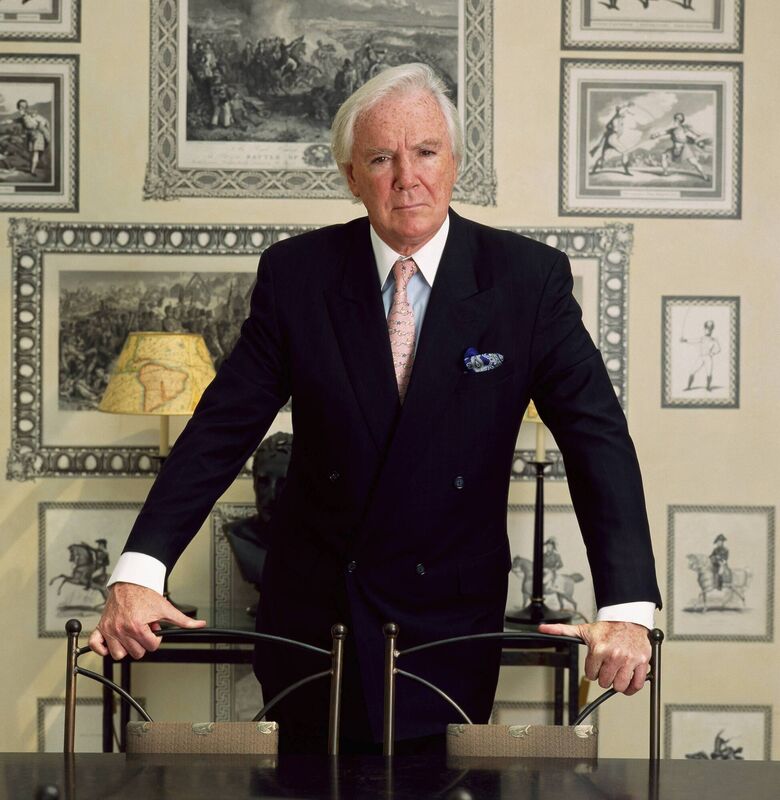

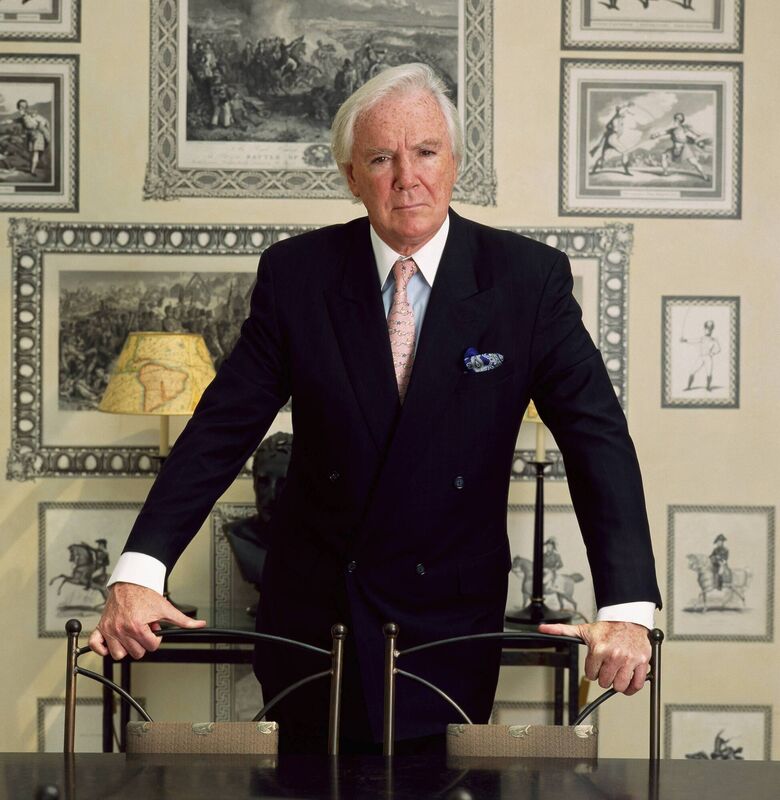

Over 40 years, Tony O’Reilly built a business empire that included newspapers, crystal and china, telecoms, hotels, oil and mining prospecting, as well as ‘Big House’ trophy properties, and discount supermarkets.

Mr O’Reilly leveraged his considerable sporting fame and honed a much-storied talent for marketing food brands.

The ascent was more remarkable for his not coming from a notably wealthy family, although he did enjoy the good fortune of taking his first steps in business at a time when the Irish economy was opening to the world.

Mr O’Reilly went on to deploy the multi-millions earned as a high-profile CEO in the US to finance and raise loans in Ireland. In the end, what he built was a collection of disparate stock market and private business interests.

Worth considerable sums at the top of the market during the noughties boom, the debt-laden family empire was nonetheless ill-prepared for an extraordinary series of economic and corporate blows — more fitting material for a Netflix series than anyone could have suspected.

The events surrounding the collapse of the empire eclipsed the heroics of his early business ventures.

Mr O’Reilly unsuccessfully fought to keep rival Denis O’Brien from gaining control of Independent News and Media, the newspaper group Mr O’Reilly had expanded, but only with potentially crippling amounts of debt.

Independent News and Media’s then chief operating officer Gavin O’Reilly voting with his father and former chief executive Tony O’Reilly at the annual general meeting, in Dublin, in 2006. Picture: Leon Farrell/RollingNews.ie

Despite weathering his fair share of corporate scares, Mr O’Reilly failed to anticipate the extent of the banking and property crash. Ultimately, the scale of the debts was laid bare.

Forever financially fragile, the Waterford Wedgwood business was the first to fail in 2009.

A few years later, he lost control of Independent News and Media to Mr O’Brien, the rival Mr O’Reilly had bettered in the intense fight for Eircom only a decade or so earlier.

O’Reilly fought off AIB in the Irish courts to opt for bankruptcy in the Bahamas, where the Irishman owned one of his luxury homes. The last group of creditors was officially paid off at the start of this year.

The loss of Independent News and Media hurt hard. At 36, he had got control over what was to become Ireland’s largest newspaper group. He was subsequently helped along the way by the poor decision making at the owner-managers of the rival Irish Press.

However, the boom-to-bust saga started in an unlikely place, at the fledgling Bord Bainne Government agency in the 1960s.

The story has been often told: O’Reilly, the marketeer, secured the top job at the dairy board in 1962, and despite some pushback from officials, helped to develop the Kerrygold brand used to this day to sell Irish butter around the world. The Kerrygold story is a reminder of the huge changes that have swept across the Irish economy since those days.

A few years later, and now at another Irish food firm, Mr O’Reilly got the break that unlocked the door to a lucrative career at HJ Heinz.

The American food firm was the equivalent of Nestlé or Unilever today. Heinz took unpromising tinned food products but, thanks to branding and heavy television marketing, the company played its part in developing western consumerism.

The UCD law graduate, who had turned to a career in business management while still playing international rugby, was now set to run Heinz in England.

Starting from 1979, he went on to hold both two top jobs at the global headquarters in Pittsburgh.

In an unusual arrangement that institutional shareholders would probably frown on these days, Mr O’Reilly juggled his time running Heinz out of Pittsburgh, while overseeing significant payouts from Independent News and Media, and building out his private investments in Ireland.

Astonishingly, large sums had been paid to the top Heinz bosses over the years. In a famous analysis, Business Week in the US calculated that Mr O’Reilly had amassed total compensation of pay and share awards of over $150m over a short period.

Scrutiny had turned to what Heinz shareholders were getting for the multi-millions paid to their top bosses.

Stock market investment vehicles were the big thing, and Fitzwilton was Mr O’Reilly’s main stock market-listed investment vehicle in Ireland — used to buy into a huge range of private companies, including road and motor signage firm Rennicks and profitable supermarkets in the North.

He eventually took the stock market vehicle private. Along the way, the Fitzwilton-controlled Rennicks was embroiled in controversy over a corporate political donation to Fianna Fáil received by then minister Ray Burke.

The idea behind the business was fusing the Irish crystal maker and England’s china manufacturer into an international luxury brands company.

The venture was always a relative minnow and, despite Mr O’Reilly and brother-in-law Peter Goulandris (his second marriage was to heiress Chryss Goulandris) injecting many millions over the years, the company struggled with changing consumer tastes and manufacturing costs.

The end came quickly in 2009, at the onset of the global banking crisis.

Tony and Chryss O’Reilly enjoying the Easter Monday at the Leopardstown Races, in Dublin, 2001. Picture: Eamonn Farrell/RollingNews.ie

Tony and Chryss O’Reilly enjoying the Easter Monday at the Leopardstown Races, in Dublin, 2001. Picture: Eamonn Farrell/RollingNews.ie

Waterford Crystal was well known on the US East Coast and Wedgwood was prized in England, but it was always a stretch — outside of Ireland at least — to believe the two brands could be the start of something big.

Luxury lifestyle brands had to appeal to the emerging youthful middle classes in China and to other parts of Asia, the consumers who in time helped propel French and Italian fashionmakers and Swiss watchmakers to become Europe’s most valuable companies.

The dropping of a Waterford Crystal ball traditionally marked midnight at New Year’s Times Square. By the time of its collapse, Waterford Wedgwood had unmanageable debts.

Mr O’Reilly got involved in the highly speculative and expensive business of exploring for oil with Atlantic Resources, when Norway’s and then Britain’s North Sea oil bonanza briefly turned Ireland’s waters into a frontier exploration frenzy.

Controversy followed Atlantic Resources from the start. The stock market shares soared and fell, and soared again, on speculation that Ireland was about to be lifted from deep economic malaise, by striking oil.

Many years later, Mr O’Reilly’s Providence Resources had a remarkably similar stock market episode before it too ran short of money.

The O’Reilly family had much more success with mining, when Arcon and the Galmoy zinc mine in Kilkenny was sold to an international firm.

In Ireland, Mr O’Reilly expanded Castlemartin, a former ascendency ‘Big House’ in Kildare, into a 750-acre stud farm estate.

In 1973, he acquired a controlling stake in the then Fine Gael-supporting Independent Newspapers, the group that was to become Independent News and Media.

Listed at an asking price of €30m, the estate was acquired by US cable king John Malone. The disposal in the same year of a home and private office on Dublin’s Fitzwilliam Square for €3m made little impression on debts of almost €200m, and failed to stave off the descent into bankruptcy.

The Ireland international cap surprised some by accepting the offer of a knighthood from the British monarchy in 2001.

Some Irish newspapers dropped the favoured title of Dr AJF O’Reilly (a reference to a doctorate earned at a university in England) to call him by the foreign title. Henceforth, he was to be called Sir Anthony.

Courting of the British establishment appeared to open no new business doors. A British newspaper at the time snootily referred to his wealth as being built on baked beans (Heinz), crockery (Wedgwood), castles, and newspapers.

His purchase of the loss-making or , also made little economic sense.

Although influential in parts of the political and media establishment there, the never made money.

Mr O’Reilly fronted a bidding vehicle, called Valentia, that won the 2001 takeover for Ireland’s dominant telecoms firm — with a takeout offer of €2.8bn.

The consortium consisted of a wall of international money provided by George Soros, Goldman Sachs, and others. It was ranged against a consortium led by Mr O’Brien, recently enriched from the sale of Esat Telecom to British Telecom. The victory, however, seeded an intense rivalry that was to haunt Mr O’Reilly to the end.

The battle for Eircom came down to which side was favoured by the stakeholder Esot, the mainly unionised employee shareholding group. Its success hinged on a change in the law that would save the Esot from paying a huge tax bill in the takeover tussle.

Tony O’Reilly successfully battled against a consortium led by Denis O’Brien to takeover Ireland’s dominant telecoms firm, Eircom, in 2001. Picture: Levenson/Getty

Tony O’Reilly successfully battled against a consortium led by Denis O’Brien to takeover Ireland’s dominant telecoms firm, Eircom, in 2001. Picture: Levenson/Getty

The Esot staff group sided with the O’Reilly consortium, but only after securing an eleventh hour change in the tax legislation facilitated by the then finance minister Charlie McCreevy.

Freedom of Information documents showed that the tax law was changed in a remarkably short period — just 14 days had passed in June 2001 from the submission of an initial request before a pledge was secured for the legislation.

Questioned three years later, Mr McCreevy told the Dáil his mid-summer tax pledge “simply provided the membership of the Eircom Esot with a level playing field to choose to support whichever bid they wished to support”. The victory for Eircom was the high-water mark for the O’Reilly empire. The enmity, if it didn’t already exist, was firmly set after the O’Brien consortium lost out.

Mr O’Reilly had first taken control of the newspaper group in 1973, but 40 years later, a costly struggle over Independent News and Media helped speed up his bankruptcy.

Along the way, Mr O’Reilly had been aided hugely by disastrous management at the rival Irish Press.

Following the Good Friday Agreement, the costly acquisition of the could at least be justified on commercial grounds — tapping all-Ireland ad revenues, even though the huge sales at the height of the Troubles were long in the past.

Following the Eircom skirmish, Mr O’Brien built his stake in the newspaper group. By that time, Mr O’Reilly had expanded Independent News and Media into newspapers in Australia, New Zealand, and South Africa.

O’Reilly famously recruited the late Ben Bradlee of Watergate and fame, in the 1990s, to be part of a huge panel of what he called an international advisory board to Independent News and Media. The advisory board would regularly fly in for hospitality at Mr O’Reilly’s Castlemartin pile or Dublin’s Shelbourne Hotel. Whatever about garnering international influence, it was hard to discern much connection between a board of international luminaries and the practical business of selling ad space in, say, the .

When Mr O’Brien continued to build a stake in Independent News and Media, Mr O’Reilly didn’t have the money left to fight him off.

Waterford Wedgwood and Independent News and Media cost him dear, exposing the unpayable debts.

AIB got the ball rolling, suing him for unpaid loans in Dublin in the summer of 2014. AIB didn’t get its way.

Mr O’Reilly subsequently was declared bankrupt in the courts in the Bahamas, but still owing around €195m.