Hotel sales in Ireland are booming, with deals this year expected to top the €1 billion mark for the first time in almost a decade.

From the Dean Hotel Group, to the five-star Shelbourne Hotel, a number of high profile properties have changed hands so far this year.

In the first ten months of the year, deals worth around €900 million have been completed.

“We would certainly expect another few hundred million euro worth of deals to complete before the year ends,” said Dan O’Connor, Head of Hotels and Living at JLL Ireland.

This is up significantly on last year, with research from DLA Piper showing that around 20 hotel deals were completed in 2023, with a total deal value of between €300 – €350 million.

“The hotel sector has proven to be a resilient asset class in 2024, in a time when commercial property activity in Ireland has generally been subdued,” said Barry Noonan, Legal Director at DLA Piper.

“By April 2024, deal value surpassed the 2023 figure, although that was largely as a result of the completion of two transactions – the Shelbourne Hotel and the portfolio of hotels within the Dean Hotel Group,” he added.

Back in April, Paddy McKillen jr and Matt Ryan finalised the deal to sell the Dean Hotel Group, which includes eight properties in Ireland, including The Dean, The Mayson, The Clarence, The Devlin, The Leinster and Glasson Lakehouse.

It’s understood that the deal valued the entire portfolio of properties at over €350 million.

More sales are set to follow in the coming weeks and months – most notably Mount Juliet Estate in Kilkenny.

A company controlled by the founder of data centre developer Winthrop Technologies is set to buy the five-star hotel.

Five individual hotel deals have dominated the market so far this year.

The five-star Shelbourne Hotel in Dublin was the most valuable single hotel transaction with a price tag of €260 million.

Kennedy Wilson were the sellers and Archer Hotel Capital were the successful purchasers.

This was Archer’s second acquisition of a five-star Dublin hotel, having acquired the Conrad Hotel in 2019.

The second most valuable deal was the four-star Radisson Hotel Dublin Airport, which Dalata Hotel Group bought for €83 million.

The country’s biggest hotel group and the owner of the Clayton and Maldron hotel brands plans to rebrand the property as a Clayton Hotel.

The Hard Rock Hotel, the Radisson Blu St Helen’s Hotel and Jacobs Inn Hostel rounded up the top five individual hotel deals.

“Those five individual assets, plus the Dean Hotel Group portfolio make up a significant proportion of overall transaction activity so far this year,” said Mr O’Connor of JLL.

Luxury hotels are taking centre stage in 2024, with activity much stronger than last year when just one five-star hotel sold.

“Luxury hotels in Ireland seldom change hands,” said Paul Collins, Head of Hotels Ireland at CBRE.

In 2023, the five-star Park Hotel in Kenmare, Co Kerry was sold by brothers Francis and John Brennan with a price tag of €17 million.

It was bought by Irish businessman and social entrepreneur Bryan Meehan.

Mr Collins pointed out that the luxury hotel sector in Ireland is relatively small in the context of the wider hotel market.

“Of the 834 hotels registered with Fáilte Ireland, only 39 hotels are classified as five-star – less than 5% of the total hotel stock,” he explained.

Mr Collins said the scarcity of such assets coming to market often results in high levels of interested parties and competitive bidding processes.

Strong demand from customers is also driving the sale of these high-end properties.

CBRE’s recent publication Luxury Real Estate 2024 noted that the global population of millionaires has expanded four-fold, increasing from 14.7 million in 2000 to 58 million in 2023.

This represents a 300% rise in the number of potential luxury hotel guests over the same period.

Global travel has followed a similar trajectory. Air passenger numbers grew from 1.7bn in 2000 to 4.5bn in 2019 and are projected to exceed 2019 levels by 2% to 8% in 2024.

“As individuals accumulate wealth, their propensity to travel increases, along with their desire for greater comfort and exclusivity,” said Mr Collins of CBRE.

“In short, the dynamics of global wealth that determine the spending patterns of high net worth individuals means there has simply been a need for more product to meet the demand, and the trajectory for the main luxury destinations appear on course to experience greater demand for the foreseeable future,” he added.

This year we’ve seen a mix of both Irish and international buyers snapping up Ireland’s top hotels.

“We have definitely seen quite active Irish interest in buying hotels,” said Dan O’Connor of JLL Ireland.

“If you go back to that list of top five deals this year, the Scally family acquired the Radisson St Helen’s Hotel and that is a family with a portfolio of hotels in Munster, with Hayfield Manor probably being the most famous in Cork City.

“So we’ve seen a lot of the deals up to €50 million which have featured Irish families, Irish high net worth individuals and private wealth,” he said.

On the larger ticket size, when you go above €100 million, Mr O’Connor said you are more likely to find an international buyer.

“If you look at the Dean Hotel Group and the Shelbourne, they were all international buyers,” he said.

As the year nears to a close, the market is showing no signs of slowing down.

The Slieve Russel hotel in Co Cavan is one of the more recent hotel sales to close.

Last month it was sold to Brady Hotels Ireland, agents CBRE confirmed.

Brady Hotels is owned by Australian based developer, Tony Brady, who is originally from Cavan.

The property had a price tag of around €35 million and was once owned by businessman Sean Quinn.

Just this week, the Yeats Country Hotel in Sligo was placed on the market by property advisor, Savills Ireland, with a guide price of €7 million.

The four-star hotel is situated in the village of Rosses Point.

So, why are so many hotel owners deciding to sell up this year and why is demand so high?

Simply put, Tom Barrett, Head of Hotels and Leisure Ireland at Savills said there are many willing buyers and sellers.

“Trade is strong, investors are optimistic about the long-term future of the hotel industry and barriers to entry for new supply are relatively high,” he said.

Hotels are also outperforming other sector such as office and retail, that have been hit by lifestyle changes that were accelerated by Covid-19 – such as working from home and increased online shopping.

Barry Noonan of DLA Piper said these sectors have not yet bounced back to pre-Covid 19 trading performances like the hotel sector has.

He also highlighted a number of other factors at play that have helped the hotel sector to outperform other commercial real estate sectors.

“These include the increasing popularity of domestic holidays, the large numbers of international tourists travelling to Ireland, particularly from the USA, as well a better overall experience for customers in Irish hotels through enhanced luxury offerings and a wider range of unique hotel experiences,” Mr Noonan said.

“Hotels have been quick to adapt to changing consumer preferences, offering enhanced experiences and services that appeal to modern travellers,” he added.

Hotels also offer a diverse revenue stream, which can be attractive for investors.

“Hotels often generate revenue from multiple sources, including food and beverage, events, and ancillary services, making them more resilient during fluctuations than other asset classes,” Mr Noonan said.

The ability of hotels to adjust rooms rates instantaneously has also proven to be a robust hedge against inflation – and not just here in Ireland.

Right across Europe, the hotel sector is accounting for a large proportion of investment volumes.

According to CBRE, all major commercial real estate sectors saw an increase in investment activity in the first half of 2024 when compared with the first half of 2023, but this was led by the ‘hotels and living’ sectors.

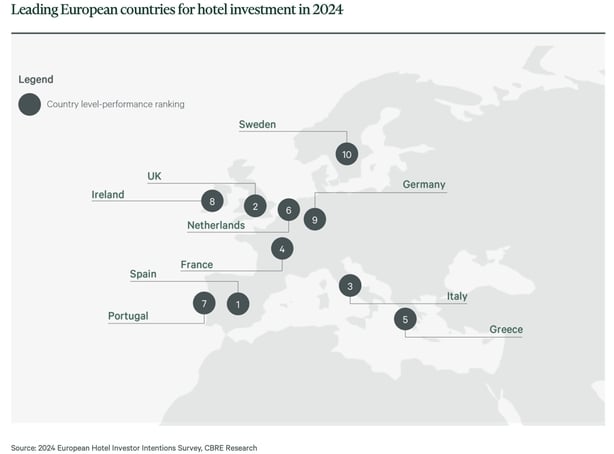

In CBRE’s 2024 European Hotel Investor Intentions Survey, Ireland ranked as the eighth most attractive destination in Europe for hotel investment.

At a city level, Dublin ranked seventh, solidifying the ongoing desire to deploy capital in Ireland.

Trading prospects are also encouraging for Ireland, as connectivity to North America from Dublin Airport continues to grow.

Mr Collins of CBRE said this is one of the key markets for luxury hotels.

Currently there are over 25 North American cities with direct flights to and from Dublin.

€500 million has been the long-running average for annual hotel transactions in Ireland, with 2024 levels not seen since the previous €1 billion peak in 2015.

According to the experts, transaction volumes are set to drop in 2025, but hotel trading performance will improve.

Dan O’Connor of JLL said the market this year is down around 5 or 6% in terms of underlying performance of hotels, and how they trade on a day-to-day basis.

“2024 was kind of the year that hoteliers struggled a little bit or caught their breath, maybe stood still at best in terms of trade performance, next year I think we’re going to see some growth again,” Mr O’Connor said.

He explained why he thinks deal volumes will fall.

“Not because investors don’t want to be in the market,” he said.

“The reality is that you’ve only got 250 or so hotels in Dublin, only 1,000 in Ireland, so if you get a year where there is €1 billion plus in transaction volumes, it can be very difficult to replicate that – you simply won’t have the product,” he explained.

“You won’t have another Radisson St Helen’s Hotel, Hard Rock Hotel, or Mount Juliet – these are special assets and they may well when they’re sold be tucked away for a generation before they sell again.”

Tom Barrett of Savills had a similar view, and expects 2025 to be a “steady and normal” year for the sector.

“Demand and supply will both grow at a reasonable pace,” he expects.

“The transaction market will remain active, but the overall value of the market will drop back from the €1 billion in 2024, which was boosted by The Shelbourne Hotel and the Dean Hotel Group portfolio sales.”